Starting a budget

While I don’t actually have any actual stats for this, I would say that 4/5 people I speak to say that they don’t run any form of budget. I’m not 100% sure why, but I do have a few theories.

- People don’t care enough to consider a budget as long as they have money left at the end of the month

- The general public don’t actually know how starting a budget can help them financially

- Most people think a budget is a complex concept designed to rule every aspect of spending and, therefore, don’t want to consider it

So I’m going to first break down what I mean by ‘budget’ and then dive into the What, Why and How of starting a budget.

What is a budget?

For me, a budget is an estimation of your income and expenses over any given period of time. This estimation of cash flow may or may not be reviewed at the end of the given period to determine how you have fared financially. That’s it. My definition of a personal budget is widely encompassing and purposefully vague. But why?

Starting a budget shouldn’t be time consuming, restrictive, or complicated. If it is, then the average person would get fatigued and quit before learning anything about their financial habits or effectively getting anywhere.

So, by having a vague definition, I open up the idea that budgeting is easy. All you have to know to run a successful budget is your income and rough monthly expenditures. Once you have that down, then it’s easy to scale up by incorporating all of the 5 components of personal finance in your budget if you wish. But even if you keep it simple, what is the purpose?

Why you should be budgeting

As far as financial habits go, starting a budget is one of the most important. It helps you understand and take charge of your overall spending, proactively increase your savings, get out of debt and help you get ahead. Most importantly though, I’ve found that budgeting gives people a better sense of financial contentment; and, isn’t this something we should all be striving for?

By keeping an eye on our income and expenses, we gain a better understanding of where our money actually goes. By reviewing what we have learned about our financial habits we can then rearrange our expenses to more effectively clear debt, build up emergency funds, and plan for known expenses. Subsequently, this removes any need to worry as we know we’re making the best possible financial decisions and that our assets at large are safe.

When our short and immediate futures’ are safe and accounted for, the budget will then also tell us how much we can safely invest towards our financial future and retirement. We can then stop worrying and simply focus on enjoying the present.

So, if you find yourself constantly overspending, thinking about money, or worrying about your finances and your future, you should try starting a budget. If you’re still not convinced, read this 6 Reasons Why You Need A Budget article by Investopedia article. If you’re sold, that brings us to How.

How do I start budgeting?

Several budgeting methods exist which range from easy to time consuming. All have their own merits and should be used depending on what outcome you are looking for and how much time you’re willing to commit.

Zero-based budgeting

Zero-based budgeting is a technique where all of your income is accounted for over a specific timeframe – say a month. What you do at the beginning of every month is to write down your total expected income and assign a job to every single dollar. Whether that job is paying rent, going towards student loans, paying off credit card debt, groceries, takeaway or simply dedicated to savings, you want to make sure that all of your money is accounted for and has a task.

ZBB is good because it removes uncertainty and you should know exactly where your money is going every month. You also know that you will save and invest a certain amount because it is already predetermined at the start of the month. At the end of each month you want to review your expenses to see where you were able to stick to the allocated allowance, and where you weren’t. Each month can also look completely different to the last and if that happens you can simply allocate extra money where needed; like towards Christmas gifts in the months of November and December.

The biggest benefit of Zero Based Budgeting is that you will get an intimate knowledge of your personal finances and learn to develop solid financial habits if you manage to stick to your specified allowances.

However, there are a few downsides. ZBB is time consuming and if you are a budgeting beginner it will be difficult for you to know where your money should be allocated. With your first few attempts you will probably underestimate your grocery and entertainment allowance, and completely overspend. But that’s OK – it’s all a learning process.

Am I a fan of ZBB? Not really. I think it is more restrictive and time consuming than a budget needs to be; but, a lot of people do need the discipline that comes from knowing where every penny goes. If this is you, then give it a crack! I much prefer the 50/30/20 method.

50/30/20

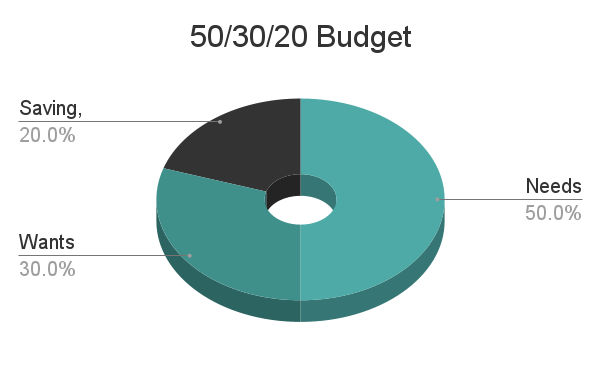

Popularised by Senator Elizabeth Warren in her book All Your Worth, the 50/30/20 method is more of a guideline to your expenses, than a strict allocation or tracking budget. It also requires much less work which makes it perfect for beginners.

Rather than trying to figure out exactly how much you should allocate and spend in specific categories every month, you simply want to ensure that your expenses are loosely broken down into 3 categories by percentage.

50% Needs expenses – these include rent, minimum debt payments, groceries, insurance and all utility bills.

30% Wants (discretionary) expenses – anything that you want to spend your money on but isn’t crucial to your survival. Netflix, gym, clothes, eating out, hobbies, and other entertainment.

20% Savings, Investments, and extra Debt Repayment – which isn’t as self explanatory as Needs or Wants. This 20% allocation should either be saved, invested or used to pay off debt early. Which one of the three depends completely on your current financial health. For example, if you don’t have an Emergency Fund, you should be allocating the 20% to building this up. Once you have an emergency fund you should use the 20% to pay off any high interest debt. Finally, when you’re high interest debt free, have saved for future known expenses and have a barrier protecting your finances, you should start investing towards your retirement.

Personally I like this budgeting model since it isn’t too restrictive and you don’t have to count every penny. It also quite clearly shows you if you are frivolously spending. In addition, you can be quite adaptive with the percentages as long as you stick to 2 rules:

Never go over the 50% Needs or 30% Wants allocation; and,

Don’t use less than 20% to save, invest or pay off debt.

The only downside with the 50/30/20 budgeting guideline is that you really need to know how you should be spending your last 20%. Most people think simply saving is a good idea, but it really depends on your financial health. For example, if your financial health says that your liquidity ratio is 9+, then you need to put your money elsewhere – like towards long term investments. A good fiduciary fee Financial Planner can help identify personal targets for you. That’s me! Get in touch!

From most time consuming to the easiest budgeting technique, I’m going to round it off with the pay yourself first model.

Pay yourself first

This budgeting method is beautiful in its simplicity and focuses mainly on prioritising saving, investing and paying off debt. I first came across it reading one of my favourite books The Richest Man in Babylon by George Clason, where he stresses the importance of making sure that your future is taken care of, before meeting any other financial needs. Essentially, the main point is to save, invest or clear debt with 10-20% of your monthly income as soon as it hits your account, and then live off of the remaining 80-90% however you see fit.

I love this for many reasons. The main one being that most people simply save whatever money is left in their accounts at the end of the month; but, by doing so it is way too easy to indulge in impulsive ‘wants’ and draining your account before you can save anything! Instead, by simply removing 10-20% of your income as soon as it hits your account there is never any risk in using “too much money” because you are free to spend all of the remaining 80% of your income.

It’s simple, efficient and perfect for anyone who doesn’t want to take the energy to track their expenses.

Summary

A budget, when done right, reveals the truth about your finances and spending habits. This can be a little bit daunting, but is an important hurdle to clear on our path to financial happiness and freedom. Starting a budget should never feel restrictive or specifically stop you from buying something that you want if you can afford it. Instead the budget should simply help you get what you want in an affordable way, while also protecting your financial health.

If a budget still sounds like too much, think of it loosely as a petrol gauge on your car/bike. You use a petrol gauge to tell you how much gas you have left in the tank, but you don’t necessarily use it to stop you from driving. Instead you simply use it to give you an informed decision on how far you can go and if you need to ration some petrol for more important trips, as opposed to going on a joy ride.

If you want help with analysing your financial health and to get you started on a budget, simply hit the button below and book a consultation.