Embarking on your financial planning journey as an expat in Vietnam can be exciting, albeit a struggle. On the one hand, you’re living in this incredible country rich with culture and history, with beautiful sites and a booming economy. But, on the other hand, so-called “independent” financial advisors offer no real help to expats, you likely won’t get access to a public or corporate-sponsored pension plan, and lifestyle creep is real despite most things being relatively cheap.

So how do you navigate your personal finances while being an expat in Vietnam? First, you get financially literate. The easiest way is to read blogs, articles, and books, attend talks on the subject and chat with your mates!

But you can start with this article. Here we dive into the 4 key areas of personal finances in Vietnam that you as an expat should get acquainted with.

What Does Personal Finance Mean? Personal Finance là gì?

Personal finance refers to the management of individual or family financial resources. It encompasses all aspects of financial life, including income generation, spending, saving, investing, and protection against risks. Subsequent elements of personal finance include budgeting, setting financial goals, and creating a plan to achieve these goals.

The concept of personal finance is universal, but it takes on a unique flavour in every country due to local economic conditions, cultural norms, and regulatory environment.

For example, developed nations have already started acting on the looming financial crisis of an aging population and reduced workforce that will adversely affect longstanding pension systems. The solution is to enforce corporate-sponsored pension plans to help make individuals invest towards their futures. Such actions have yet to be implemented in many developing nations, including Vietnam.

By diving further into the meaning of personal finance, or “personal finance là gì” in Vietnamese, you will gain a better grasp on finances in general. And, understanding more about managing personal finances in Vietnam is key to winning long-term with money as an expat.

Unique Flavour of Personal Finances in Vietnam

Vietnam’s phenomenal economic landscape has allowed it to become the fifth largest economy in Southeast Asia, according to the International Monetary Fund (IMF), and the 41st largest in the world over just the last few decades.

This incredible boom brought international recognition to Vietnam, led to billions of dollars of foreign investment and resulted in a thriving international community tagging along for the ride.

With this rapidly growing economy and still relatively cheap cost of living, Vietnam offers a plethora of opportunities for personal investing and wealth creation. However, like any country, it also presents unique risks and challenges.

Having a complete understanding of these opportunities and challenges as an expat provides you with the ultimate opportunity to successfully manage your personal finances in Vietnam.

Financial Opportunities in Vietnam

Vietnam’s Growing Economy

Vietnam’s growing economy has led to a surge in both local and foreign business in Vietnam and subsequently become a top destination for entrepreneurial expats to both work and live. This is because Vietnam is a huge market to tap into with a young population, relatively stable political system and a booming middle class ready to dive into new experiences.

So while it has become increasingly expensive and difficult for foreigners to open a company in Vietnam, the opportunities are plentiful if the hurdles can be overcome!

Personally, I know people who have started companies in nearly every industry. From B2B Growth to Media, Tech, Gaming, Design, Education and Counselling, you can do almost anything and thrive in Vietnam. If they did it, there’s no reason why you can’t succeed, too!

Job Opportunities

From teaching English in public schools to being a senior engineer working in construction, a Director of a logistics firm, a lawyer or a footwear designer, there is no lack of job opportunities in Vietnam.

Unfortunately, just like opening a foreign-owned company, landing the best jobs has become increasingly difficult. However, with the right qualifications and experience in your field, there are still a multitude of options available to expats that can help set you up for future financial success.

High Average Salary for Expats

Apart from the incredible culture, country and people, a major incentive for expats to move to Vietnam is the salaries. According to HSBC’s Annual League Table 2019 study, the average annual salary for expats in Vietnam was USD $78,750.00 and while I don’t know the size of their data sample, I can imagine their figures to be accurate.

Of course, those numbers are the average which will be skewed by a few incredibly high earners. Realistically, and at the lower to lowest end of the scale, expats can expect to earn anywhere from USD $2,000.00/month which can go very far taking into consideration the low cost of living.

Generally Low Cost of Living

One of the biggest opportunities for financial growth in Vietnam comes in the form of the generally low cost of living. Regardless of how much you earn, the ability to keep expenses low provides expats with the opportunity to put away a significant part of their income every month, if managed correctly.

In fact, Numbeo statistics show that the cost of living is on average 56% cheaper in Vietnam than in the US, and the cost of rent is roughly 78% cheaper, as well. Therefore, even if an expat’s salary is on the lower end of the scale, they will be able to find opportunities to grow their wealth if they manage their money wisely.

| Produce | Average Cost (VND) | Average Cost (USD) |

|---|---|---|

| Milk (regular), (1 gallon) | 137,291 ₫ | $5.62 |

| Loaf of White Bread | 23,283 ₫ | $0.95 |

| Rice (white), (1 lb) | 10,543 ₫ | $0.43 |

| Eggs (regular) (12) | 39,418 ₫ | $1.61 |

| Chicken Fillets (1 lb) | 42,020 ₫ | $1.72 |

| Apples (1 lb) | 36,027 ₫ | $1.47 |

| Banana (1 lb) | 12,223 ₫ | $0.50 |

| Oranges (1 lb) | 16,907 ₫ | $0.69 |

| Tomato (1 lb) | 12,446 ₫ | $0.51 |

| Potato (1 lb) | 14,230 ₫ | $0.58 |

| Onion (1 lb) | 14,181 ₫ | $0.58 |

| Lettuce (1 head) | 20,665 ₫ | $0.85 |

| Water (1.5 liter bottle) | 12,626 ₫ | $0.52 |

| Domestic Beer (0.5 liter bottle) | 21,124 ₫ | $0.86 |

| Imported Beer (12 oz small bottle) | 34,586 ₫ | $1.42 |

| Cigarettes 20 Pack (Marlboro) | 30,000 ₫ | $1.23 |

HYSA and Fixed Term Deposit Options

One of the biggest opportunities for wealth creation in Vietnam is tied to banks, high-yield savings accounts and fixed-term deposits. While they have come down in recent years, it is not unheard of for Vietnamese Banks to offer 10% interest on longer fixed-term deposits and anywhere between 3-7% interest on deposits up to 6 months.

With easy access to such high guaranteed returns on fairly liquid assets, expats can readily utilise various fixed deposit schemes to increase their wealth and actively make their money work for them.

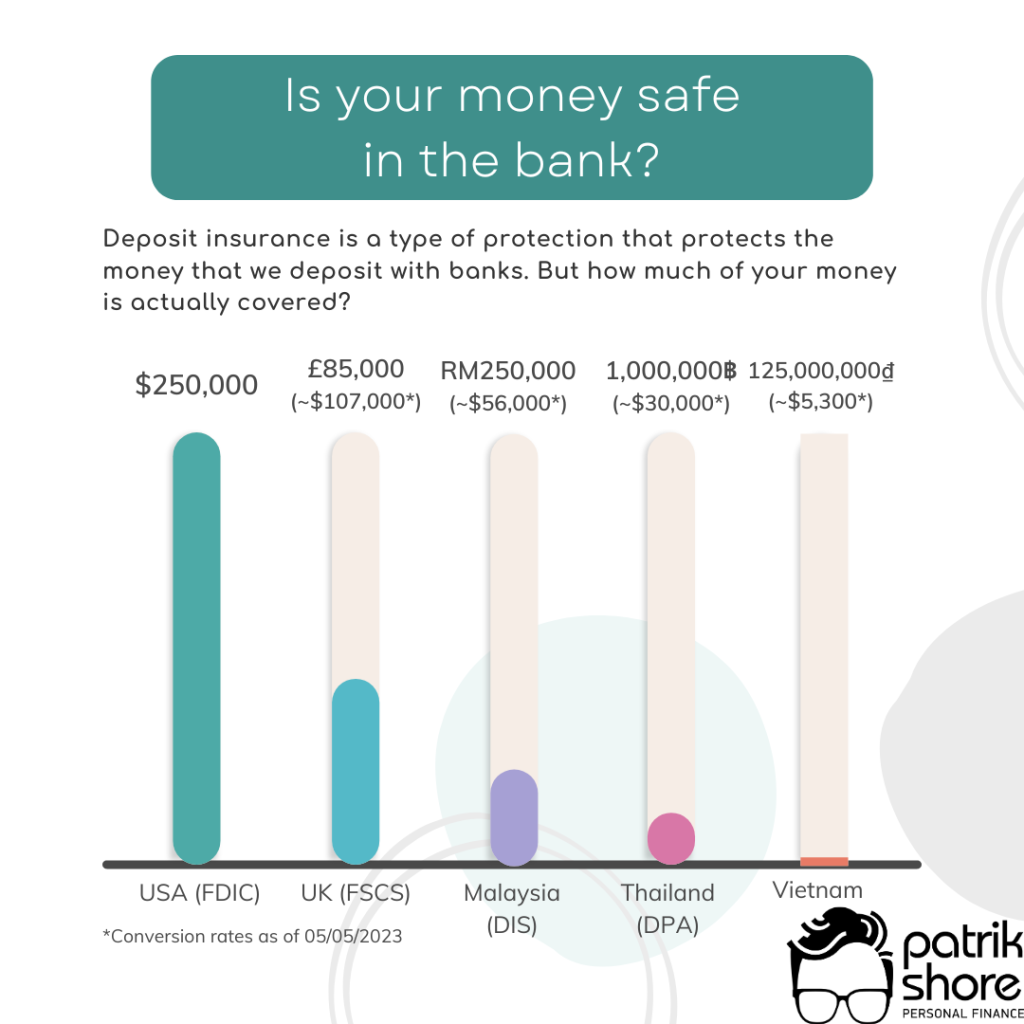

| Note: While generally considered safe, deposits in Banks in Vietnam are only insured up to VND 125,000,000₫ (~USD $5,100.00). This is not a large amount and should be taken into consideration when investing through HYSAs or fixed-term deposits in Vietnam. |

Financial Challenges in Vietnam

Strict Financial Regulations

Like many developing nations, Vietnam has very strict financial regulations in place to control the flow of money in and out of the country. While most of these make sense from a country’s financial standpoint, expats in Vietnam are often caught up in miles of red tape whenever they try to do anything banking-related.

For example, expats can open local bank accounts in Vietnam but only if they can show a valid visa or residence permit lasting 12 months or longer. While some banks may offer exceptions to this rule, the bank account will likely come with multiple restrictions.

Expats also face other banking restrictions. For example:

- Money can only be transferred overseas into an account in your name

- You may have to justify any overseas transactions

Furthermore, the interpretations of any of the regulations can change at the drop of a dime. So where a banking practice has worked in the past, it may not always work in the future depending on the bank and employee you’re dealing with at any specific time.

“Independent” Financial Advisors

One of the biggest financial challenges in Vietnam and Southeast Asia is trying to stay away from so called “independent” financial advisors. Independent is in quotations because nearly every financial advisor in Asia acts as an agent of one or several product providers. By being agents of products and providers they are, in fact, not independent because products and providers needs are placed above your needs as a client.

The reason why “IFAs” are a financial challenge is because the products that they propose often sound good on paper, but have a bunch of hidden fees that are hard to comprehend. Any investments that you make will likely also be impeded by high management fees, missed payment penalties, high ongoing fund charges and advisor kick-backs.

Unfortunately, these advisors also still implement tactics that have long been illegal in more developed countries since the financial collapse in 2009. These include:

- Cold calling to elicit new business where no previous client relationship has been established

- Taking commissions when providing investment/financial advice

- Not fully explaining financial products

- Making unsuitable recommendations that you won’t understand (usually to generate more commissions for themselves)

- Stating to be an “independent” financial advisor when they are in fact restricted

Find a Fee-Only Financial Planner

Fee-only financial planners are the new norm in the ‘West’. Fee-only means that here are no hidden fees and the planner has your best interest at heart as they’re not incentivized by commissions from product sales.

Lifestyle Creep

Just like in your home country, lifestyle creep can be a real financial challenge in Vietnam. Most expats move here with great intentions to earn a good salary and save a lot of money. Unfortunately, lifestyle creep, travel and other luxuries often eat into the excess money they are earning and significantly hamper any real long-term financial growth.

Keeping up with the Jones’ is the most common term related to lifestyle creep. It indicates that people will spend more and more money simply to keep up with the people around them. If someone buys a new car, then you will also buy a new car because you don’t want to be judged for driving an older model.

For expats in Vietnam, keeping up with the Jones’ is slightly different! More often than not expats end up travelling together, on expensive holidays, or go on 5-star weekend retreats. Things like flying business class, Sunday hotel brunches and wine bars also quickly eat into any chance of hitting financial goals.

Risk Management

Risk management in personal finance refers to the ability to protect all your financial assets. This includes using mitigation techniques to protect yourself from unexpected financial outlays such as medical costs, and managing your investments to avoid unnecessary risk.

The simplest risk management technique is using insurance to offset any future large expense. Unfortunately, most expats in Vietnam don’t plan for and are shocked by the cost of insurance when living abroad. Expats have to learn that health and life insurance is not cheap and that any cheap insurance is simply not worth having.

All expats in Vietnam and Southeast Asia should at the very least consider:

If risk management is not taken seriously, there is a very real likelihood that you will end up with a medical emergency that will significantly impact your financial health and overall well-being.

Expensive Tuition

Tuition is one of those children’s expenses that many of us plan for, but only when it comes to university and not throughout childhood. Unfortunately, tuition for expat children in Vietnam will cost several thousand dollars every year.

This cost is often overlooked by many foreigners who have either never had to think about this before, or weren’t actually planning on having kids while living abroad. However, plans change and we should all take into consideration how we would pay for tuition costs should having children abroad becomes a reality.

Financial literacy among Vietnamese people is gradually improving, thanks to efforts from the government and private sectors. However, there’s still a long way to go. As an expat, understanding the nuances of personal finance in Vietnam can help you make informed financial decisions, leading to financial security and prosperity.

4 Key Areas of Financial Planning

When it comes to financial planning in Vietnam, or “financial plan là gì” four key areas require attention: investing, budgeting, saving, and managing risk.

Investing in Vietnam: Opportunities and Challenges

Due to the country’s fast-growing economy, investing in Vietnam can be rewarding. As an expat, you also have multiple investment avenues to choose from; ranging from the Vietnamese stock market to real estate, businesses and entrepreneurship. However, Vietnam may also offer more investment challenges than other countries due to regulatory uncertainties, language barriers, restrictions on foreign-owned real estate and market volatility.

When it comes to investing in Vietnam I would generally consider:

- Opening an international investment account with a well-known brokerage

- Utilising decent Vietnam bank HYSAs

- Speaking to a fiduciary financial planner

- Entrepreneurial endeavours

When investing while in Vietnam I would generally avoid

- Any investment product offered by banks or independent financial advisors

- Any insurance product that has an investment element

- “Independent” financial advisors in general

- Investing in property and/or land in Vietnam as an expat

Budgeting as an Expat: Tips and Advice

Budgeting as an Expat in Vietnam can be quite different from what you’re used to depending on your job. Many expat contracts provide foreigners with a housing allowance, yearly flight to home country, gym memberships, drivers and other financial perks. All of these reduce or remove several budgeting factors and frees up income to be used elsewhere.

Ideally, any money that you would normally spend on rent or accommodation should immediately be invested toward long-term financial goals, but excess cash can also be allocated to clearing debt or saving towards medium-term targets, such as buying a house.

However, where budgeting in Vietnam doesn’t differ from your home country is the need to track your income and expenses in some form. Knowing exactly where your money is going, is the key driver to financial success.

There are several budgeting techniques that you can use including:

- 50/30/20 model

- Zero-based budgeting

- Pay yourself first

- Incremental budgeting

I know that choosing the right budgeting model for you might not be easy. Here are a few quick tips for finding the right one.

- Consider your needs and goals. What do you want to achieve with your budget? Are you trying to save money, pay off debt, or grow your business?

- Think about your resources. How much time and expertise do you have to devote to budgeting?

- Evaluate the advantages and disadvantages of each model.

- Choose a model that you are comfortable using and that you can stick with.

Saving as an Expat: A Guide to Financial Security in Vietnam

Saving as an expat is truly no different from saving in your home country and saving just enough is important for both your financial security and hitting long-term financial goals. The only way in which saving as an expat differs is that you have to carefully consider how safe your money is and where you want to hold your cash.

For example, banks in Southeast Asia are generally less reliable and financially sound when compared to banks in developed countries. Due to this, the money that you have deposited in Vietnamese or other Southeast Asian bank accounts may not be as financially secure. Where banks in developed countries will protect your deposits up to and over $100,000, developing countries will often only secure a fraction of that amount.

With the above said, I also know that saving money in Vietnam isn’t always the easiest thing to do despite the low cost of living. From one expat to another, here are some tips that I use to save a little bit more money every month.

- Establish a regular saving habit and set aside money at the beginning of every month (Pay Yourself First)

- Transfer money into savings abroad to be held in a major currency (USD, EUR, GBP, CAD, AUD etc.)

- Avoid tourist traps with inflated prices

- Learn a few Vietnamese phrases to help negotiate better!

- Embrace the local market culture for cheaper produce

- Don’t shy away from saying ‘No’ to functions and events

Managing Risk in Vietnam: How to Protect Your Finances

Managing risk in Vietnam is one of the most important factors to financial success. Having worked in the insurance industry in SEA for a long time, and lived in Vietnam for 5 years, I can’t tell you how many people’s financial health I have seen be negatively impacted by a lack of risk management.

Managing risk involves protecting yourself and your finances from any and all potential financial pitfalls. This includes everything from mitigating financial stress through the use of good insurance to diversifying your investment portfolio and wearing protective gear while on a motorbike.

Here are the top risk management techniques in personal finance:

- Acceptance – Accepting risk means that you know that there is a risk to either you or your financial well-being and you opt to retain that risk as opposed to utilising any other risk management technique. For example, if you have a pre-existing health condition as an expat that cannot be covered by international private medical insurance you will have to accept and retain the risk of any medical costs for that illness.

- Avoidance – Avoidance is simply identifying that a risk exists and then simply not participating in or putting yourself in a place to incur that risk. Many expats in Vietnam for example, don’t drive their own motorbikes simply to avoid the risk of being in a motorbike accident. Others don’t invest because they are scared of the stock market, and some don’t eat street food to avoid potential food poisoning. Everyone has their own definition of risk and risk tolerance.

- Transference – Transferring risk means that you identify that a risk exists and transfer any loss from that risk onto a third party. In nearly all instances, this means using insurance to transfer the risk of a potentially high future financial loss to an insurer in the exchange of paying the insurance provider regular premium payments.

- Sharing – Sharing risk is similar to transference where you have accepted that a risk occurs, but you’re not willing to either pay the cost of transferring the risk completely or think that it would be more worthwhile to simply accept part of the risk. Risk sharing in health insurance usually comes in the form of a deductible or co-payment, where you as the insured accept to pay a set amount of the initial medical costs in return for a cheaper premium.

- Sharing risk is often also done by business owners and entrepreneurs, where they share the upfront financial burden of starting a company with investors, in addition to sharing potential future profits.

Ask yourself this: do you think wealthy people don’t have health or life insurance because they don’t believe in it?

The answer is: No. Wealthy individuals are usually the first ones to look into insurance coverage. Not because they can simply afford it, but because they know the importance and value of transferring risk away from themselves to protect their overall assets.

Resources for Navigating Personal Finance in Vietnam

It can be incredibly tough to identify any good and reliable resources to navigate your personal finances here in Vietnam. The majority of hits on Google simply lead you to insurance companies or “independent” financial advisors who want nothing more than to sell you on their products.

However, it’s not a complete loss and there are resources at your disposal. For example, my main mission with this site is to teach you all about personal finances for expats and how to manage your money by yourself. You can also increase your financial IQ by reading other informative blogs such as:

- Millionaire Expat

- Investopedia’s Personal Finance

Conclusion

Navigating your personal finances in Vietnam can be both rewarding and challenging. Knowing the pitfalls that you may face is the first step to being financially successful, and the second step is taking action to increase your financial growth wherever possible.

Personal finance isn’t all about saving money. You need to also learn what tools and techniques are available to you in order to make your money work for you. Focus on the 4 key areas of risk management, budgeting, saving and investing, and you will be just fine! But don’t wait, the only thing you have on your side is time.

Happy financial planning in Vietnam!