Personal finance and financial health are two key terms that you need to know as they directly relate to your personal financial situation. Not knowing either or only knowing 1, would be like driving a manual car but not knowing how to change gears. You might go forward but the ride won’t be smooth.

Once you know what personal finance & financial health means, you then need to truly understand their importance and their impact on your financial future. If you don’t know this, then you’re just driving around in circles and grinding gears until your car fails.

But for now, let’s just cover what they are.

Personal Finance

Broadly speaking, personal finance focuses on the personal management of your money as either an individual or family. It relates to the “how to” aspect of money management and contains key areas one should grasp in order to practice good fiscal sense. For example, “How do I get better at saving?”.

It should be noted that while personal finance is often interchangeably used with financial planning, the two are not the same.

To put it in simpler terms, let’s go back to the vehicle metaphor. Personal finance would be the theoretical knowledge and understanding of all the parts of an engine, while financial planning puts that knowledge into practice and helps you build an engine. There is no way you could build a good financial plan without knowing personal finance, similar to not being able to build an engine without knowing what each part does. Make sense?

So what do we need to know in order to effectively manage our money? This is where I break personal finance down into five categories: income, spending, saving, investing, and protection. Read my full article here, but a quick breakdown is:

Income

Income is the money you earn, and how you earn it. There are several different forms of incoming but the most common is earned. Many people do reach financial independence solely off of their earned income, but many more do not. One goal everyone should have in life is to try and build a few different streams of income. This doesn’t mean you have to have a side hustle or work 2 jobs; you can also have interest, dividend, or rental income supplementing your earned salary.

Spending

Spending isn’t as simple as just buying stuff or buying less. For personal finance and financial health, spending more often than not relates to financial habits and understanding how you can control your spending in a financially sound and efficient manner. It’s also knowing how much you spend and where you spend it.

Saving

Saving: similar to spending, saving comes down to financial habits more than simply hoarding cash. There are tactics you should use and strategies you need to implement to make your saving efficient and, at some point, come to an end. That’s right, there is a finite amount of money that you should have saved, because saving is not everything nor will it help you retire.

Investing

Investing is probably the most interesting aspect of personal finance for some, and the scariest for others. I’ve found from my work that most people simply ignore investing as a whole because they don’t know where to start or are afraid to, while others invest more than they should and put their financial health at risk. Slow and steady wins the race when it comes to investing.

Protection

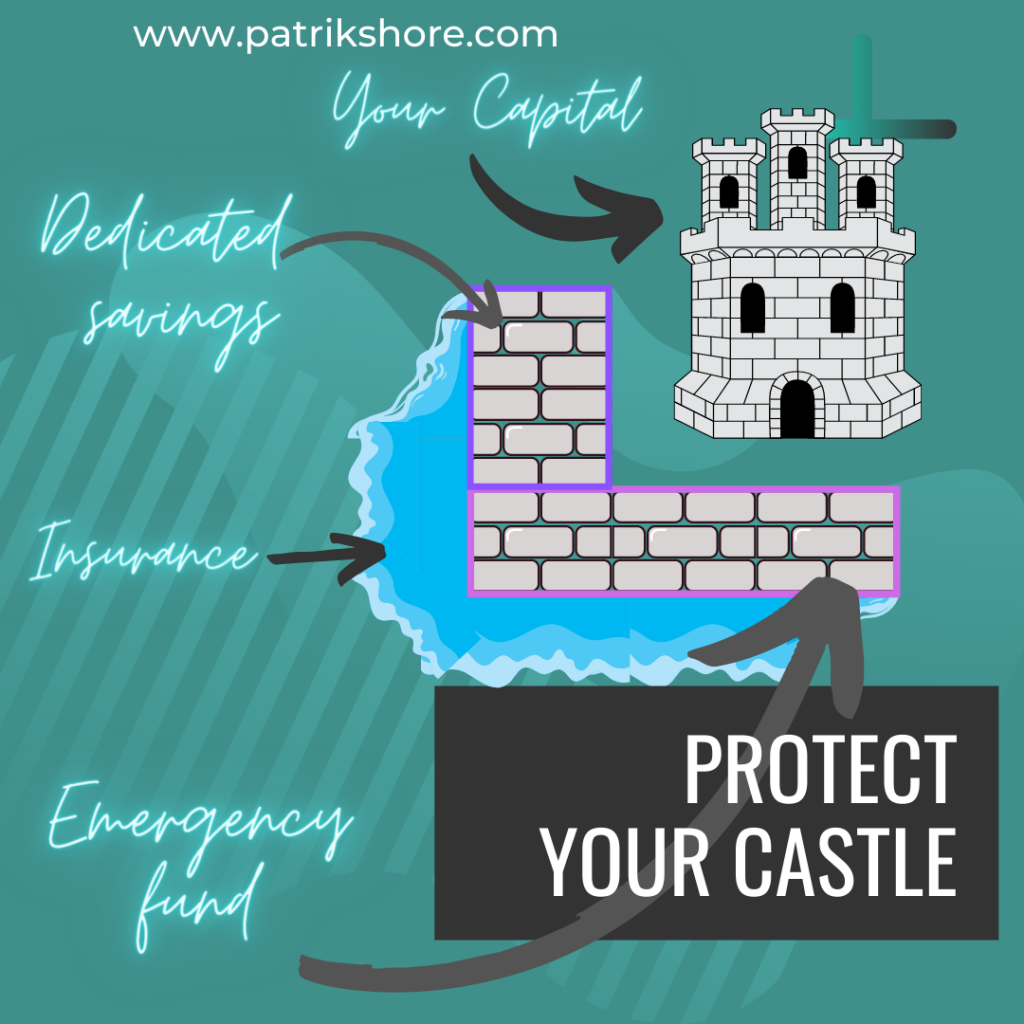

“Everything that is of importance to you should be considered your keep, and you need to do everything you can to protect your keep from loss.”

If investing interests people the most, protecting yourself from risk and implementing risk management techniques interests people the least. For me though, this is the most interesting aspect of personal finance. I explain the importance of protection by using my castle metaphor. Everything that is of importance to you should be considered your keep, and you need to do everything you can to protect your keep from loss. This is where risk management comes into play. You take out insurance, you build up specific savings and you get out in front. In short, you do everything you can to protect yourself from physical and financial loss.

That’s personal finance 101; now on to financial health.

Financial Health

Financial health is much like your emotional health and well-being. While the vast majority of us push it aside it is something that should be spoken about often and loudly, out in the open and heavily researched. Sadly, it’s something that we as a general public know frighteningly little about. So when our financial health is suffering and we are struggling, we simply think this is “normal” and don’t seek the help we need.

But what is it?

Financial health is the term used to determine and describe the state of your money and finances. There are various calculations that you can make, and aspects of finances you can review to determine your financial health. Personally, I start very simply by reviewing someone’s personal finances and you can start here too. Ask yourself:

- How much are you making and how much do you spend?

- How much do your assets total and how much liability (debt) do you carry?

- What percentage of your income are you saving, and do you save proactively or reactively?

- Do you even know what you are saving for, and when you have saved enough?

- Are you investing and do you have an investment strategy?

- Do your investments have a specific end goal and do you know when you will reach it?

Lastly, but most importantly, review risk management strategies. Consider if either you as a person or your financial situation is at risk and could be harmed or lost by any specific event. This could be a health crisis, unexpected travel or relocation costs, veterinary expense, you name it. The “it won’t happen to me” mindset is not a risk management strategy.

Inevitably the question comes: “how do I know if my financial health is bad?”

The answer is fairly straightforward and can be identified based on the answers to the questions above. I believe that everyone has the innate ability to know if their financial health is good on the macro, but maybe not how to adjust on the micro.

For example your financial health can easily be determined by something as simple as having heaps of debt despite making a good wage, or living paycheck to paycheck. It can also be identified through your financial habits and attitude towards money, as opposed to your financial figures. One clear example is always thinking about or worrying about money in one way or another. This negative financial habit usually leaks into other aspects of your life and let’s money run your life, as opposed to having a plan to make your money work for you.

But financial health can also be incredibly nuanced.

- A positive net worth and positive monthly cash flow are good indicators of health, but not if you aren’t able or haven’t paid off bad debt.

- Having no debt whatsoever is a good financial health indicator, but not if you live paycheck to paycheck or don’t implement any risk management strategies.

What I’m trying to say is that not only people who struggle financially have poor financial health. Many people who are very wealthy also have bad financial health simply because they aren’t financially literate.

I think Andrew Hallam sums this up perfectly in his book Millionaire Expat:

“Some wealthy people drive high-end, expensive cars. But most rich people prefer Fords and Toyotas.”

“Some wealthy people live in million-dollar homes. But most millionaires live in homes that are worth less than a million dollars.”

From Andrew Hallam’s book, Millionaire Expat: How to Build Wealth Living Overseas

While there is no one true guide to a healthy financial life, it often includes several of the following aspects:

- Not worrying or considering how much something costs

- Regularly investing between 10-20% of your monthly income

- Have a fully funded emergency fund

- Being able to give freely

- Not using credit cards, or paying off credit cards in full every month

- Living significantly below your means

- Having a full life financial plan

- Running a budget

All in all

Now you know, in broad strokes, what is meant by personal finance and financial health. Personal finance relates to the “how to” management of your money, and financial health describes the state of your financial situation.

What you should do now is continue increasing your financial literacy around both subjects and trying to find ways of incorporating better money management practices into your day to day. This in turn will improve your financial health and will provide you with a great platform from where you can build a financial plan.

Remember, don’t just save more money. Instead identify how much you need to save and what you are saving for.

Don’t just invest more money; instead, calculate how much you need to invest, over a specific amount of time, in order to be able to retire comfortably at a certain age.

Don’t simply believe that you are safe from risk. Write down everything that could cause you physical or financial loss, and develop a strategy to manage those specific risks.

You can’t accidentally find your way into a comfortable and financially independent future. You need knowledge and a plan.