Being an expat in Vietnam, or any foreign and developing country, comes with a whole heap of challenges and risks. Not only are you likely taking a leap of faith into the unknown, but you’re also exposing yourself to a number of risky situations that you might not face in your home country.

In Vietnam for example, there are over 65 million registered motorcycles with data indicating that there are at least 7.6 million motorbikes in Ho Chi Minh City alone. With this number of motorbikes on the road and the driving conditions that exist in the country, expats in Vietnam face a very real danger that they wouldn’t face at home.

Apart from physical risk, expats around the world also encounter financial risk in the form of income, expense, investment & assets and debt risk. Learning how to manage risk as an expat is therefore vital in order to protect yourself from significant loss.

This article serves as a guide, providing insight into different types of risk that expats in Vietnam will face along with information and strategies to manage risk on your own.

Understanding the Importance of Risk Management for Expats

Risk management is the series of steps taken to identify, measure and mitigate personal risk. It also includes any implementation of risk management strategies over time and the ongoing monitoring of strategies in place.

The importance of risk management for expats cannot be understated. It is without a doubt the most important thing you should consider as it protects you as a person, your current financial situation and your future financial freedom from harm or a significant setback.

It includes everything from, but not limited to:

- Using face masks to protect from pollution

- Wearing helmets when riding a motorbike

- Transferring risk with insurance

- Diversifying and balancing investment portfolios

- Ensuring assets are fully protected

Example: Transferring Risk

An example of risk management is obvious when we consider health insurance. Expats can face significant medical bills getting treated for illnesses in international hospitals. In order to offset the potential cost of large medical bills in the future, expats can buy health insurance and thereby trade smaller, regular premiums for coverage down the line.

This is a fairly obvious example of a specific risk and risk management. However, expats also face many more risks that aren’t as easily identifiable.

The nuances of Financial Planning

Navigating risk is part and parcel of financial planning, but it’s only one aspect. Don’t forego Investing, Saving, Budgeting and your Spending.

Types of Risks Faced by Expats in Vietnam

Expats in Vietnam and Southeast Asia face any number of risks that are as broad and diverse as the countries and cultures we live in. Unfortunately, due to the lack of understanding of risk, most people only tend to associate risk with a few physical types of danger that also exist in our home countries. These include:

- Illnesses

- Injury

- Death

However, risk doesn’t solely come in the form of physical danger and the personal financial risks we face can be equally as detrimental to our futures and health. Financial risks include:

- Inflation risk

- Interest rate risk

- Currency risk

- Market risk

- Regulation risk

Expats also have a third risk category which includes miscellaneous “dangers” that can affect our current plans, financial futures and job security.

- Political risk

- Job security

- Banking risk

Knowing that all these types of risk exist is the first step in protecting yourself from undue loss. For example, if we don’t know about currency risk we wouldn’t plan for it. If we don’t plan for it, we might end up keeping all our savings in a volatile currency that will likely lose us money over time.

Obviously, each of the risks outlined above can significantly impact your life as an expat. Therefore, understanding how to manage the risks effectively is key to your peace of mind and overall well-being. That’s where risk management techniques come in!

4 Risk Management Strategies for Expats in Southeast Asia

Learning how to manage risk successfully is one of the most important factors in achieving long-term financial success. And, anyone who misinterprets risk, undervalues risk management strategies or outright ignores risk is setting themselves up for potentially huge financial and physical loss. Which is unfortunately not uncommon.

This is a bizarre phenomenon because we spend so much of our time attempting to build wealth, but somehow we quickly brush off any dangers that could considerably eat into our net worth.

Once you have identified all the different types of risk that you face as an expat, you want to implement at least one of the following 4 risk management techniques.

- Acceptance – Accepting risk means that you know that there is a risk to either you or your financial well-being and you opt to retain that risk as opposed to utilising any other risk management technique. For example, if you have a pre-existing health condition as an expat that cannot be covered by international private medical insurance you will have to accept and retain the risk of any medical costs for that illness.

- Avoidance – Avoidance is simply identifying that a risk exists and then simply not participating in or putting yourself in a place to incur that risk. Many expats in Vietnam for example, don’t drive their own motorbikes simply to avoid the risk of being in a motorbike accident. Others don’t invest because they are scared of the stock market, and some don’t eat street food to avoid potential food poisoning. Everyone has their own definition of risk and risk tolerance.

- Transference – Transferring risk means that you identify that a risk exists and transfer any loss from that risk onto a third party. In nearly all instances, this means using insurance to transfer the risk of a potentially high future financial loss to an insurer in the exchange of paying the insurance provider regular premium payments.

- Sharing – Sharing risk is similar to transference where you have accepted that a risk occurs, but you’re not willing to either pay the cost of transferring the risk completely or think that it would be more worthwhile to simply accept part of the risk. Risk sharing in health insurance usually comes in the form of a deductible or co-payment, where you as the insured accept to pay a set amount of the initial medical costs in return for a cheaper premium.

- Sharing risk is often also done by business owners and entrepreneurs, where they share the upfront financial burden of starting a company with investors, in addition to sharing potential future profits.

Once you know these four risk management techniques you can start diving into their real-world application and successfully plan for the dangers you face.

Insurance Options for Expats in Vietnam

One of the most effective ways to manage risk as an expat in Vietnam is through the use of insurance. Insurance falls under the transference risk management strategy, where you identify a potential future threat and transfer the cost of that risk to an insurance provider.

A common insurance option that expats don’t consider seriously enough is the use of critical illness or life insurance. Ignoring the fact that cancer is among the leading causes of death in the world and that 39.5% of people will be diagnosed with cancer at some point in their lives, according to the National Cancer Institute (NCI), critical illness and life insurance should always be considered if you have any loved ones that rely on your income.

Other insurance options for expats include:

- Health insurance (aka International Private Medical Insurance)

- Life insurance

- Critical illness insurance

- Auto insurance

- Travel insurance

- Home and content insurance

While you may not need all of the insurance listed above, it would be prudent to consider any insurance that covers your health to protect you against financial loss. If you’re struggling to wrap your head around the ins and outs of insurance, check out my guide to the best insurance brokers in Vietnam that can help.

Expat Health Insurance in Vietnam

Health insurance is a critical aspect of risk management and a must-have for any expat living in Vietnam. This is because the healthcare system in Vietnam, and throughout Southeast Asia, is significantly different to what we’re used to in our home countries. Medical costs for normal illnesses can be astronomically high and relying on public healthcare can be incredibly unreliable.

Expat health insurance will provide you with a wide range of coverage from normal outpatient visits with a general practitioner to inpatient hospitalisation and surgery. Health insurance can also cover all the smaller costs that you may not even consider, such as physiotherapy and rehab after a serious injury or illness, or routine health checks to stay on top of your health.

Apart from the “normal” health-related medical costs people may think of, expat health insurance can also provide coverage for:

- Dental treatment

- Vision

- Out of area emergency care

- Maternity related costs

- Mental health

- Palliative care

When choosing a health insurance plan, it’s important to consider factors such as the coverage limit, the network of hospitals, the claim process, and the cost of the premium. It’s also advisable to choose a plan that provides coverage for chronic and pre-existing conditions, as these are often excluded from standard policies.

Managing Investment Risks as an Expat in Vietnam

Vietnam’s rapidly growing economy means that it presents numerous investment opportunities for expats; ranging from Vietnam’s stock market to private business ventures, entrepreneurship and real estate. However, since Vietnam also comes with more investment challenges than other countries due to regulatory uncertainties, language barriers, restrictions on foreign-owned real estate and market volatility, it means that you also have to take due care to manage these investment risks.

Investment risk is the potential of your investments falling in value. This risk increases or decreases depending on the investment itself and can also be determined by how much an investment is likely to lose. Is there a possibility that you will lose your full investment, or is there a limit on the downside risk?

To manage investment risk, the most common recommendation is to diversify. Simply put, spread your investments over numerous companies, industries, regions and asset classes. The main goal is to reduce the risk of any single investment negatively impacting your entire investment portfolio.

For example, investing in the stock market can be risky if you just invest in single stocks. This is because if a company that you invested in goes bankrupt you might lose everything. But, if you invest in an ETF or index tracker that includes hundreds of different company shares, your risk of loss is more or less limited to normal market fluctuations.

Similarly, a lot of people love the idea of investing in property and land but don’t consider investing in stocks or bonds. Especially as expats, buying real estate on foreign soil comes with a lot of risk and should really only be considered by experienced investors and part of a very large investment portfolio.

Dealing with Currency Risk as an Expat in Vietnam

Currency risk is another significant concern for foreigners living abroad and it refers to the risk in changes of price from one currency to another. Also known as exchange-rate risk, currency risk can inadvertently affect an expat’s income, purchasing power and overall investment performance.

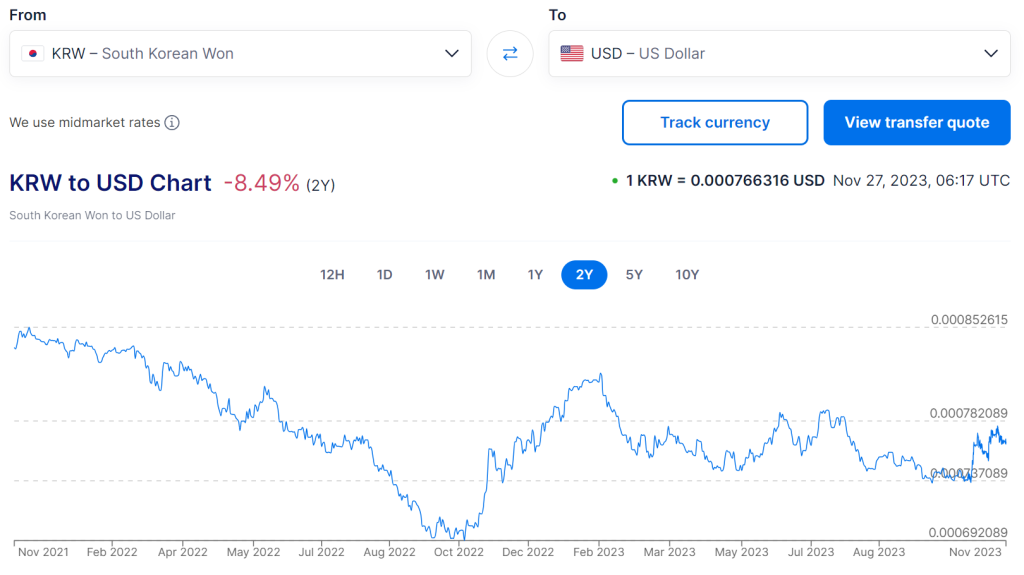

For example, if you earn your salary in South Korean Won (KRW) but all your overseas expenses are in USD and you transfer money abroad on a regular basis, the value of your income would technically decrease as the KRW weakens against the USD.

As can be seen by the chart below, the KRW has decreased 8.49% between November 2021 and November 2023. When transferring KRW for USD, you can now only buy ~8% less USD than you could two years ago, which essentially lowers your income by the same amount.

But how do we deal with currency risk as expats?

Unfortunately, expat salaries don’t increase just because the currency in which we’re paid decreases in value against more stable currencies. If only! Often we’re lucky to get the standard 2% raise that most people get and in today’s day and age, even luckier if our annual raise matches inflation.

But, we still have to deal with currency risk. So how do we manage risk that is out of our control?

The best way is to keep the largest portion of your savings and assets in a stable currency such as the USD, EUR or GBP. Better yet, the stable currency that you choose should match the currency of your future liabilities. I.e. if you intend to retire in Europe, then you’d want to invest and save in EUR and should consider the Euro as your base currency.

While having a base currency doesn’t protect you from current currency fluctuations, it can protect you from future losses in exchange rates. No one can accurately predict the future or say with certainty that one currency will get stronger or weaker than another. However, it is likely that a satellite currency (VND, KRW, THB, MYR, PHP) will weaken over time when compared to core currencies (AUD, USD, GBP, EUR, CAD).

The Impact of Interest Rate Risk

Interest rate risk is the risk that any interest earned on a fixed deposit investment is less than you could earn on another, similar low-risk investment product. Interest rate risk is also the possibility of being locked into a fixed rate for a fixed term when you might otherwise have been able to take advantage of lower interest rates on the market.

Similar to currency risk, there is no definitive way to know how future interest rates will fluctuate. As such, it is impossible for us to completely avoid interest rate risk. Regardless, the best way to deal with interest rate risk as expats is to not overcommit. Don’t overcommit to long-term deposits, fixed-interest contracts or rates, unless the cost is exceptionally low or interest earned exceptionally high.

A “don’t keep all your eggs in one basket” approach is always the best strategy when trying to manage risk.

Political Risk for Expats in Vietnam

Political risk is another crucial aspect that expats in Vietnam should factor into their future plans. Will unlikely that any drastic changes will occur, changes in the political landscape can affect various aspects of your life, from the economy to your legal status as an expat, the latter being the most common.

Expats in Vietnam have seen it before and will likely see it again. When work permit and visa terms and conditions are changed, it causes significant delays to applications which can stop foreigners from working altogether and even have them travel abroad to obtain new business visas for re-entry.

To manage political risk, it is important to stay informed and regularly keep up to date with news and local forums to get insights and stay on top of various reforms. It is also advisable to have some form of a contingency plan. Whether it is having enough funds to cover an immediate exit strategy or to keep a flexible lifestyle that allows you to adapt to change quickly.

Conclusion: Manage Risk as an Expat in Vietnam

Navigating your personal finances as an expat in Vietnam is hard enough without also having to consider risk. And, it is not without nothing that I say that risk management and financial planning will ensure that your life as a foreigner goes smoothly and without issue.

Now that you understand that numerous risks exist, you will be able to adopt one of the 4 risk management strategies outlined in this article to curb the potential harm that they could have on you and your finances. Ultimately, this will give you the peace of mind that you may need in order to make the most of your expat experience in Vietnam.