My main goal is to help build financial literacy, which is lacking globally throughout all generations and social classes. An incredibly important aspect of this is investing since it specifically relates to our future survival and comfort. Fortunately, there is a change on the horizon and more and more people are looking to invest to secure their futures. In one cohort this is more important than others: expats.

Unfortunately, there aren’t many clear-cut explanations on how to go about investing. It can be a head-scratcher trying to figure out the what, why and how’s of trying to invest yourself. That is why I have summarised what you need to know in order to start investing throughout this guide and hopefully it does enough to help you get started with your own investing as an expat.

How does investing work?

Investing is simply trading your current money into an asset that you hope will grow in value over time. Then, in the future, you want to be able to sell that asset for a significant profit so that you can use the accumulated wealth during retirement. Some investment assets will even pay you an annual income. Unfortunately, investing as an expat isn’t as easy as the definition makes it sound, but it also isn’t too complex if you take the time to learn.

As a DIY investor you will be investing into certain asset classes. These assets include the equities market, which is stocks and shares of companies, and/or the bond market and hopefully you will be investing in funds, specifically ETFs. By investing in funds/ETFs you will receive shares of the fund proportionate to how much you invested. When the stocks or bonds within your fund grow in value, so too will your initial investment.

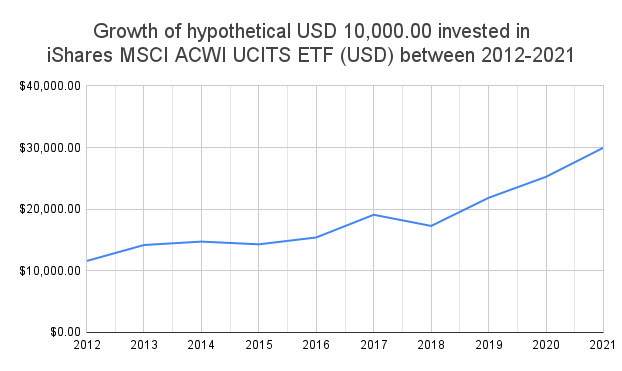

Below you can see an example of how a hypothetical $10,000.00 USD investment in the global iShares MSCI ACWI UCITS ETF fund would have grown in value from the start of 2012 through 2021. Over the course of the 10 years, that $10,000 USD would have grown in value to ~$30,000 USD.

Why you need to invest as an expat.

You need to invest as an expat to ensure that you have enough money to cover living expenses when you get older. If you don’t then you may have to rely on someone else or a meagre social pension plan, which noone should want. In fact, social pensions may not even exist in their current state when a lot of us reach retirement and, even if they do, would they sustain the lifestyle you want to live?

Currently, for 2022-2023, if you retired in the UK and had contributed to national insurance for the last 35 years, you would be eligible for the maximum social pension of £185.15/week. That’s just £9,627.80/year and it’s only going to get worse. Social pensions aren’t even keeping up with inflation! For example, the UK pension increased just 3.1% this year, in a year where inflation is +7%. Because of this dire pension situation, the UK, and countless other countries, have developed mandatory supplementary retirement schemes which are often rolled out through your workplace.

Unfortunately, however, these supplementary retirement schemes have yet to be included in the majority of expat contracts. So not only will we not get the benefit of social pensions, but we also don’t get access to the newer schemes that are supposed to complement them! This is why we need to invest.

If the retirement pension situation isn’t enough of a reason, here are a couple more reasons why you need to invest as an expat:

Hedge against inflation

- Inflation is the killer of savings and cash. It eats away at the value of money every year and come retirement your savings won’t be worth the same as when you stashed it. This is because the purchasing power of money depreciates when prices on goods and services increase.

Compound interest

- Compound interest is only something that we can take advantage of with time. It is the growth on the returns of our invested capital and it accumulates at an exponential rate. Compound interest is the reason we can’t wait before we start investing.

How to invest as an expat?

The easiest way to invest as an expat is to open an investment account with an online brokerage. By doing so, you will get access to stock markets where you in turn can invest your money into funds and other assets. Back in our home nations, we would normally have access to wonderfully incentivised investment accounts such as IRAs, ISAs, TFSAs or Supers, but, unfortunately, expats need to rely on third-party investment platforms.

But how do we go about this? Below I briefly outline 3 steps to help you start investing.

Step 1: Open a brokerage account

In short, an online brokerage is an investment platform created by a company which facilitates our access to all sorts of investment markets. They are a virtual middleman between a buyer and a seller of a financial instrument (aka investment product) and we, therefore, need an account with a brokerage in order to invest.

Formerly, brokerage firms were very expensive because investing itself was difficult. Brokerage firms bridged the gap between buyers and sellers of investment products but charged a lot of money for their services. Luckily, digitalisation happened and online brokerages replaced the majority of expensive firms, making investing accessible and financially viable to the average person. Us average people are now referred to as retail investors.

A few of the best international brokerages for expats are

- Saxo Bank (Saxo Trader)

- Interactive Brokers

- TD Ameritrade Singapore

- Trading 212

Step 2: Transferring money to your investment account.

Transferring money to your investment account, aka brokerage account, for the first time can be quite scary. Not only are you moving your money from the relative safety of your bank that you can visit and touch, but you’re also taking potentially your first step into investing which carries its own stigma. So start small. When you make your first transfer, just send a small amount of cash: $100, $1000, or whatever you are comfortable with. Once you see that it’s arrived safely into your investment account, you’ll be confident when sending more.

However, you have to consider the cost of transfer fees. When you transfer your money to your brokerage account you will in all likelihood have to do so through an international bank transfer which will incur a bank transfer fee. Because of this, you don’t want to be transferring too many small sums. If your bank transfer fee is $20 and you’re transferring $1,000.00, that’s 2% of your capital gone. However, if you transfer $3,000.00 that’s only 0.67% in fees.

Important Note: Not all brokerages allow money to be transferred from a third-party source. This is due to anti-money laundering regulations that exist all over the world. Therefore, money transfer platforms such as Wise may not work. I advise that you always transfer money directly from your bank account.

With the above said, don’t sweat the fees. They aren’t fun, but they shouldn’t stop you from investing. If your money is held in a different currency to your investment account you may also face unfavourable conversion fees. This may make it feel like you’re just losing money, but consider the trade-off. Not investing at all?

Step 3: Investing your money!

You’re nearly there, but sadly finding a brokerage and transferring your money into the investment account are the easy steps. Now you have to actually invest your money and build an investment portfolio. To do this, you need to know a little about finance. Fortunately, just as online brokerages have made investing easier, so have things called ETFs.

ETFs fill an entire article in their own right, but just know that they stand for Exchange Traded Funds, they’re an easy way to invest in equities and bonds, they’re cheap, and they automatically diversify your investment. ETFs are essentially a bag of stocks or other assets all wrapped into one bundle. Instead of having to buy several specific assets, you just have to invest in an ETF which will automatically give you exposure to assets you’re interested in. It sounds complex, but once you get into it, it’s not!

For example, say an investor wants to invest in the entire world. Instead of buying thousands of individual stocks, all they would have to do is invest in a Global ETF. A great such ETF is the iShares MSCI ACWI UCITS ETF by BlackRock. This ETF includes over 1600 stocks from developed and emerging market countries, spread throughout all major industry sectors.

A beginner investor should use a couple of different ETFs to build a simple investment portfolio. An example investment portfolio with an 80% equities and 20% bond split could be as follows.

| Asset Class | Allocation Percentage | Fund | Ticker | Expense Ratio (Cost) |

|---|---|---|---|---|

| Equities | 50% | iShares MSCI ACWI UCITS ETF USD (Acc) | SSAC | 0.2% |

| Equities | 30% | Vanguard FTSE Developed Europe UCITS ETF | VEUD | 0.1% |

| Bonds | 20% | iShares Core Global Aggregate Bond UCITS ETF USD (Dist) | AGGG | 0.1% |

Important Note: Investing does come with risk and if you are going to invest yourself make sure that you have your personal finances in order. You should never invest more than you can afford, which means that you need to ensure that you have enough liquid assets to cover you for emergencies. You should also never invest money that you will need in the next few years. Investing is a long-term solution for your retirement. Not a 5 year get rich quick scheme.

Pros and Cons of DIY Investing

Organising your investments as an expat is not without its drawbacks. There is a lot of financial knowledge that you need to learn in order to get started, but once you are up and running the investing experience is fairly trouble-free. As long as you have the emotional strength to withstand anxiety and the steadfastness to stick to your investment strategy when the stock markets are in turmoil, you will be fine. Trust me.

However, before you dive in and start do-it-yourself investing, you should considered the pros and cons.

Disadvantages of DIY Investing

- Tax implications for expats vary and can be complicated

- There is a fairly steep learning curve if finances aren’t your strength

- Financial jargon can often be confusing

- Emotions do have a real world impact on investing

- It does take time and an interest (but not a whole lot)

- Watching your investments decrease in value is a nightmare

Advantages of DIY investing:

- Once past the initial hurdle, it’s fairly straightforward

- You can avoid lots of fees that could otherwise seriously impact your investment portfolio

- No-one cares more about your money than you – you know you have your best interest at heart

- Watching your money grow and start working for you is amazing

In order to have the mental fortitude needed for investing you absolutely need to know that you are financially stable because if you invest more than you can afford there can be serious consequences. The best way in doing so is by having a solid financial plan.

This is where I give the most help and I recommend that anyone seeking to invest by themselves do get financial planning advice in advance. Feel free to book me through the button below. (Self promotion over!)

Can I lose money investing?

Yes, you can lose your money when investing. This is a very common question and the answer is, truthfully, yes. However, it is important to know that you can decrease the odds of losing your money if you invest “the right way”.

For example. If you only invest in specific stocks then it is likely that you will make a bad investment and lose a lot of money. A hundred things could happen to the company that you invested in that will make its stock value crash. They could be embroiled in a scandal, carry huge debts that they can’t pay, be outmaneuvered by competitors making them obsolete, or simply fall out of favour with investors. If any of these things happen, the demand for the company’s stocks plummet and so too will your investment.

However, by investing “the right way” through ETFs and other funds, you will minimise your risk because you aren’t invested in any one company. If an ETF holds stocks from 1,000 different companies and one of those companies goes bust, it will have a very limited effect on your overall investment. Like if you have 1,000 marbles and lose 1, it won’t be a big deal. But if you only have 10 marbles and lose 1, that’s a big loss.

It should be noted though, that even if you are invested through ETFs your investments will still fluctuate with the overall stock market. Some years the market might decline a lot, 5, 10 or even 20% even, but over time markets will on average always go up. That is why when you invest as an expat, you should always be looking 10, 15 or 20+ years in the future since that is when your investments will pay off.

You can do it!

Anyone who tells you that it is dead-easy investing by yourself will be glazing over some hurdles all investors face. Hurdles that include:

- Not understanding financial jargon

- Issues with deposits and withdrawals

- Technical problems with investment platforms

- Building an investment portfolio

But while it can be a bit tricky getting started, it is definitely doable and within everyone’s ability. Online brokerages and ETFs have made investing so much easier and cheaper than before and as long as you take the time figuring out exactly how to get up and running, you’ll be cruising in no time.

If you have any questions, feel free to drop a line in the comments below. If I can help, I will!