As someone who has always been interested in personal finance, I know that earning money, or rather knowing how to earn more money, isn’t always easy. While having a job is important because it provides you with a steady income, it is also important to learn how to build multiple streams of income in order maximise your earning potential.

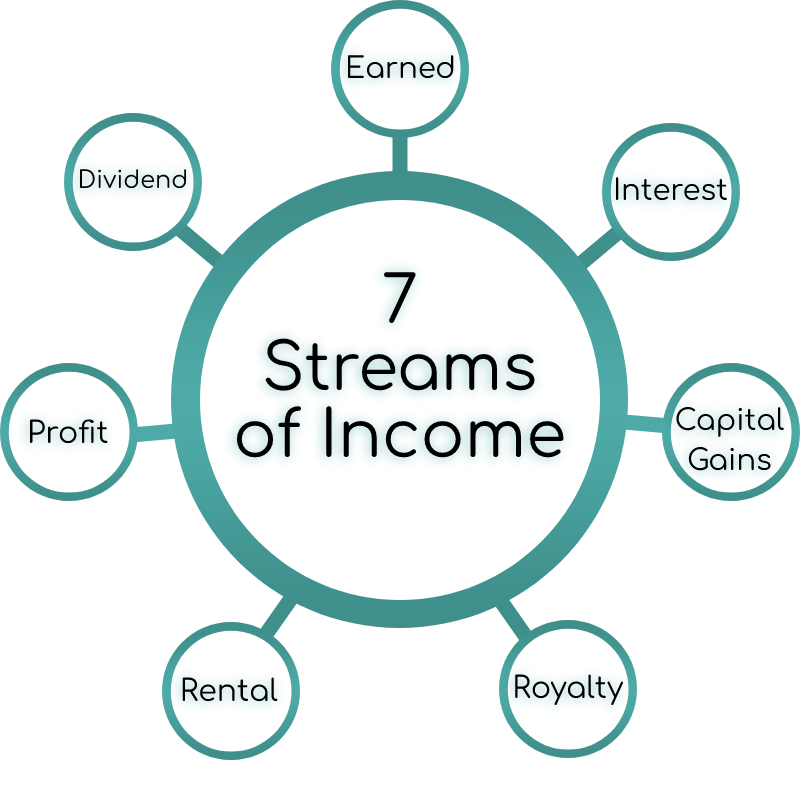

In this article, I dive into the 7 different income streams that you should know in order to broaden your financial horizons and secure your financial future.

Understanding the 7 Different Income Streams

Before we dive into the different types of income, it’s important to understand what income is. Income is simply the money that you earn and there are two main types: earned income and passive income. Earned income is money that you earn by working, for example, your salary from your job, while passive income is money that you earn without having to actively work for it. This can include rental income, interest income, and dividend income as detailed below.

If you’re still at the beginning of your personal finance journey, I suggest you give my personal finance article a quick read as it explains income in the context of the 5 essential components of personal finance.

The Importance of Having Multiple Streams of Income

Having multiple streams of income is important for several reasons. Firstly, it can help you to become financially independent. If you rely solely on your job for income, you are at the mercy of your employer. If you have multiple streams of income, you are less reliant on one source of income, which can provide you with greater financial security.

Secondly, having multiple streams of income can help you to achieve your financial goals faster. If you have additional income streams, you can use this money to pay off debt early, save for a down payment on a house, or invest more for the future.

Lastly, having multiple streams of income can provide you with greater flexibility in your career. For example, you may be able to take a lower-paying job that you are more passionate about, as you will not be as reliant on your salary.

Earned Income

Earned income is money that you earn by working. This can include your salary from your job, bonuses, and overtime pay. Earned income is the most common form of income for most people. However, relying solely on earned income can limit your overall earning potential.

While not feasible for many of us, the easiest way to increase your earned income is to ask for a raise. Another option is to freelance in order to gain a second salary or you can look for opportunities to earn extra income at your current job, such as taking on additional responsibilities or working overtime.

Interest Income

Interest income is money that you earn from interest on savings accounts, bonds, and other investments. This is a form of passive income, as you do not have to actively work for it. Interest income can be a great way to earn money without having to take on additional work and is the most important way in getting your earned income to work for you.

Try to think of the money that you have made as little “mini-earners” in their own right. Mini-earners that you ideally want to be out earning you extra income as opposed to lazy money living rent free in your bank account.

To maximize your interest income, you can put your mini-earners in various investments with high interest rates: for example a high-yield savings (HYS) account. If you have $10,000 mini-earners in a HYS account paying you a 4% pa interest rate, your money will have made you another $400. Additionally, you can consider investing in bonds or mutual funds that pay regular interest.

Capital Gains Income

Capital gains income is also a form of passive income that comes from the sale of an asset, such as stocks or real estate, at a higher price than you paid for it. It is an excellent way to increase your streams of income as you do not have to actively work for it.

In order to maximize your capital gains income you need to invest in assets that are likely to appreciate in value over time. The assets can be stocks, real estate, or anything else that has the potential to increase in value. While you don’t have to actively work for capital gains you have to make sure to research and invest in up-and-coming areas to get the most out of your investment. A lot easier said than done.

Unless you love finance and plan to spend a substantial amount of time researching possible investments, I recommend you go with the invest and forget strategy of investing in ETFs.

Dividend Income

Dividend income is money that you earn from owning stocks that pay dividends. Dividends are payments made by companies to their shareholders and is another form of passive income, as you do not have to actively work for it.

To maximize your dividend income, it’s important to invest in stocks that pay high dividends. These companies are often known as dividend aristocrats as they have a long history of paying high dividends consistently over time. Dividend investing is an investment strategy in and of itself as it usually comes with less volatility but provides investors with a steady income.

Rental Income

Rental income is money that you earn from renting out a property that you own. This can include renting out physical items on an individual basis, a rental property or a spare room in your home. Rental income is a form of passive income, as you don’t have to work for the money that you receive.

Rental income isn’t something that you just stumble into. It takes time and patience to save enough money in order to buy the property that you intend to rent out. You will also need to do a lot of research and be prepared to handle any repairs or maintenance that may be needed over time.

Profit Income

Profit income is money that you earn from owning a business or from investing in a business. This can also include income from selling products or services, as well as income from dividends or capital gains. Profit income can be a great way to earn money, as it allows for greater control over your income.

To maximize your profit income, it’s important to invest in a business that has the potential for growth and profitability. Again, one does not simply come upon profit income and it is something that you need to invest time into before investing money.

However, people do build side hustles from profit income every day. Whether it’s a lemonade stand to flipping used furniture, profit income can make a huge different to your overall finances.

Royalty Income

Royalty income is the last form of income and not applicable to the majority of us. It is money that is earned from licensing intellectual property, such as books, music, or patents. It can also related to online courses or anything else that can be sold over and over through online sites such as Udemy, Etsy or Pinterest without any additional input from yourself. This is another form of passive income, as you do not have to actively work for it after your initial effort, but it isn’t a viable option for most.

Courses and Resources for Learning About Multiple Streams of Income

If you are interested in learning more about multiple streams of income, there are many courses and resources available. Some popular options include:

- “The 4-Hour Work Week” by Timothy Ferriss

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Millionaire Fastlane” by MJ DeMarco

- Online courses on platforms such as Udemy and Coursera

Conclusion: Maximizing Your Earning Potential

In conclusion, having multiple streams of income is important for maximising your earning potential. By understanding the different types of income and building income streams that have the potential for growth and profitability, you can achieve greater financial security by broadening your financial horizons. If you are interested in learning more about your options for multiple streams of income, get in touch to have a chat about your finances.