Personal finance focuses on the personal management of your money as an individual or family. As an umbrella term it encompasses five monetary components: income, spending, saving, investing and protection. All of these components need to be understood and considered in order for us to live financially stable lives.

Often personal finance is mistaken, or used interchangeably, with financial planning. However, while personal finance revolves around the understanding of certain topics to lead a financially happy life, financial planning utilises aspects of personal finance to build a sustainable plan for the future. A little bit complicated, but let’s dive into the 5 components of personal finance to get a better grasp of the subject.

5 components of Personal Finance

I try to keep everything finance related as simple as possible. So, the only areas that should fall under the Personal Finance umbrella in my opinion are income, spending, saving, investing and protection. Everything else like estate and retirement planning come secondary.

Income

Income is at the top of the fan because we all need one. Most commonly our income is the money we earn in exchange for our time at work. This is known as earned income.

Other streams of income can be:

Profit – money you make from selling something. This could be bargain hunting, flipping old furniture or selling things on Amazon as a side hustle. Normally, the money you earn is heavily dependent on the time you put in, but it can also be getting rid of unwanted possessions around the house.

Residual – This is where you make money continuously from something you have created. It could be a website which generates enough viewers to earn money from Google Ads, or highly viewed Youtube videos.

Rental – While not easily attained at first, rental income is a great source of passive income. The money you receive comes from renting out an asset or property. This could be anything from a parking space, to storage, property or electronics.

Interest – In the world of personal finance, interest relates to investing. As your investments grow you may be able to draw money from your portfolio account without it affecting your underlying investments.

Dividends – Similar to interest as it has to do with investing. But rather than drawing money from your investment returns, you are paid a fixed amount every year for holding shares in a company.

Capital Gains – Often capital gains is used in the investment market when you make money from having invested in a company and then sold your shares; but, it also refers to money earned from buying and selling valuable assets such as property, vehicles, antiques etc.

When focusing on income, you want to build up as many streams of income as possible. I would recommend starting small by trying to increase your earned income and/or start selling things to get a profit income. Every little helps as long as it is worth your time.

Spending

When it comes to personal finance, spending is huge. If you don’t get a handle on your spending then you will struggle live a financially stable life. The absolute easiest way to understand your spending is by using a budget.

A budget, when done right, reveals the truth about your finances and spending habits. It should not be restrictive, nor should it stop you from buying what you want if you can afford it as I mention in my article here. A budget simply helps you get you what you want in an affordable way, while helping you understand the macro of your spending.

Why do you want to understand your spending?

Consider this; when we’re in our 20s and 30s we likely live paycheck to paycheck, or only manage to save a little every month. Why? It’s not that we’re frivolous (although, this can be the case). It’s because the rent we pay or the things we buy cost the same as it does for people in their late 30s or 40s, but we get paid significantly less than they do.

However, if we learn to understand our spending habits at an early stage in our careers, we are less likely to get stuck in a negative spending cycle where our expenses increase at the same as our income growth. For example, and just for argument’s sake, if your income grows 5% year on year you don’t want your spending to increase in step with your income. Instead, maybe allow yourself to spend 3% more every year until you reach a lifestyle that you’re comfortable with. Then let your income increase without increasing your spending too.

Lifestyle creep is the term for when your expenses continuously increase in line with your income and it is a true villain to any future financial freedom. Understanding the basics of personal finance and spending will stop this from happening to you!

Saving

Saving is a no brainer and we all know what it means. But why is it important and how do we use it to our advantage?

Savings are important because if we have enough money stowed away, it limits the risk of us having to take on new debt in order to cover unforeseen costs. If we always have to use credit cards or borrow money to cover expenses, then we will forever be in a negative financial spiral. Think of your savings as the 40 foot castle walls protecting your home, which is your financial health. Any unforeseen costs that come your way won’t make it past your walls to destroy your castle, because your savings stop them from destroying what really matters.

Now how do we use savings to our advantage?

We plan for known upcoming expenses and build an emergency fund for unknown expenses. The best thing you can do is save money as soon as you get your income, but however you save you want to do these things:

1. Identify all your upcoming known costs, identify the total expense for each thing, and save money for it every month.

- For example if you have a big holiday planned in 10 months time and the flights will cost $1500 and you need $1000 spending money; set aside $250 every month specifically for that holiday.

- Buying an engagement ring in 12 months worth $2000? Put away $167/month.

If you own a house you should set money aside for roof repairs and/or a new boiler as well. While people think these are unexpected costs, deep down you know that you will have to pay for these repairs at some point so you may as well plan for it.

2. Save up an emergency fund. Review your spending and have a fund set aside for at least 6 months worth of expenses. Remember, this money is for true emergencies only, like losing your job due to another COVID pandemic or having to travel for a funeral.

By using savings to your advantage you are significantly less likely to take on new debt, and the foundation for your financial freedom will be set.

Investing

When done right, investing is safe, reliable and a cornerstone of personal finance in which you have to participate. Investing for the long term in safe index tracker type ETFs is the only way (for the vast majority of us) to become financially free, and to ensure that we are able to retire comfortably at a reasonable age. You cannot save your way into retirement.

Investing is a huge topic in it’s own right and hard to cover in a small paragraph of one article; but, if you’re just starting down the financial planning journey you need to know that the only thing we have on our side is time.

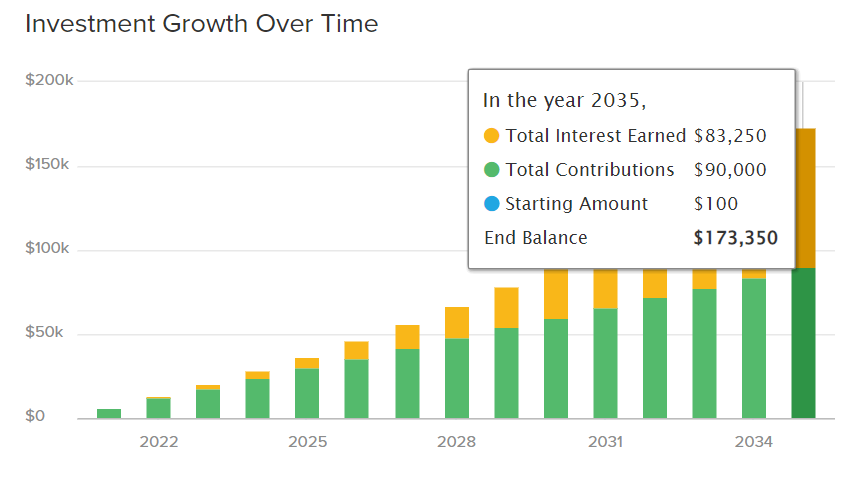

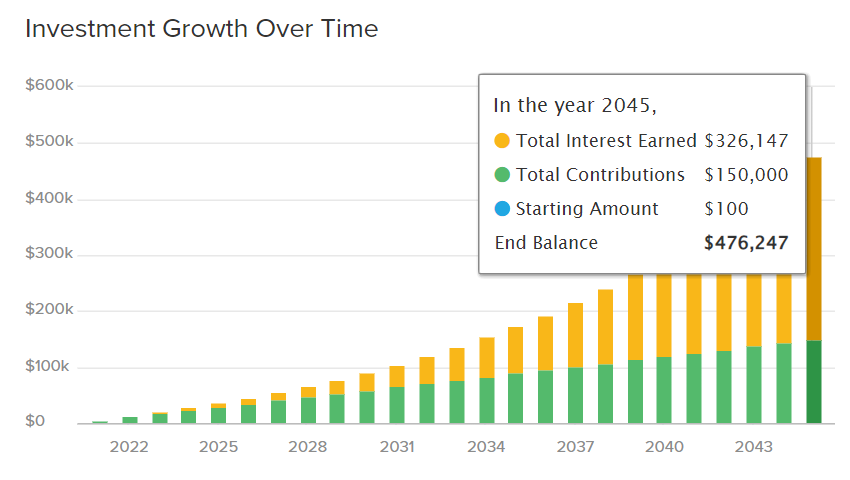

Time is on our side due to something called compound interest. This is when the compounding returns of our invested money grows exponentially. Over time, compounding interest increases our monetary growth significantly since we start to gain interest on our previous returns and not just the money we invest. Even if you don’t understand the term, it is nicely illustrated in the graphs below.

Graph 1 shows $500 dollars invested every month for 15 years with an 8% return. As can be seen you would only contribute $90,000.00 USD and have a total interest earned of $83,250.00 which totals a final account value of $173,350.00. If you simply increase the time frame to 25 years (graph 2) with all the other parameters staying the same, the interest earned would be a whopping $326,147.00, while you only contribute $60,000.00 more. In those extra 5 years, the interest itself would be more than the total account value from your 15 years of investing.

If you want to play around with figures and investment growth yourself, I highly recommend the calculator over at SmartAsset which is what I used to make the graphs above.

Protection

Protection is the final of the 5 components of Personal Finance and is the area most commonly overlooked. This is because it involves insurance which people either have misconceptions of, or don’t know how to use to their advantage. Insurance also comes at a cost, which to a lot of people seems counterintuitive when you’re trying to increase your financial health. Use money, to save money? Wait, what?

So why is insurance important and how can we use it as protection?

Earlier we said to think of your savings as the castle walls protecting your castle. Now think of insurance as the moat in front of your walls, adding that extra layer of security. It costs to keep the moat full of water, but it protects your walls from getting damaged. You don’t want to use your savings if you don’t have to.

What are some examples?

Let’s double back to the example of having enough cash to cover roof repairs, without having to take on debt.

If you pay for home and content insurance you might not have to use your savings to pay for a new roof, or boiler repairs if they are damaged in an insurable claim. However, as there are gaps in insurance cover you still need savings to you limit your exposure to risk. For home and content insurance, you won’t be covered for wear and tear; so, if your roof simply degrades over time then you will have to use your savings to pay for degradation repairs. But, by having insurance you lower the risk of having to use your hard earned money.

Another is life insurance – most people simply don’t know that this can be a financial planning tool. Consider this though, why do wealthy people pay for things like life insurance if it’s not worth it?

One of the reasons is that life insurance is not subject to tax in most countries. If you have $1 millions dollars worth of cover and pass away, your family will receive $1 million dollars. They’ll use this money to cover inheritance taxes and/or pay off mortgages in order to avoid taking on debt or losing their homes. If you don’t have life insurance and your family at least partly relies on your income to cover a mortgage, your family will in all likelihood have to sell your family home. This is a classic example of how the rich stay rich. People think it’s luck, but it’s not. They simply have contingency plans.

You can also use critical illness insurance or income protection to protect your wealth. If you have critical illness insurance and suffer from anything like a heart attack or stroke, then you will probably be entitled to a large lump sum payout. This can be used to pay for carers or to replace lost income without having to use savings or take on debt. People like to “self-insure” for these events, but do you really have enough savings to make your house wheelchair accessible?

When it comes to protecting your money it is worth thinking; what would wealthy people do? Do you think they would leave themselves open to risk, or would they do anything to decrease the odds of losing wealth? If they would, why wouldn’t you?

What it boils down to

Knowing the 5 components of personal finance should always be the starting point of your financial journey. All of our monetary management skills stem from our knowledge of these core principals, and that understanding impacts our future. The more we grow in our understanding, the better off we will be. Don’t forget, no-one is going to take care of your personal finances but you.

If you want to receive small tidbits of information to increase your financial understanding, sign up to my monthly newsletter below!